Examples of positive judgments in economics. Positive and normative economics

What is “Normative Economics”

Normative economics is a view of economics that reflects normative judgments or persuasive responses to economic projects, statements, and scenarios. Unlike positive economics, normative economics is largely concerned with value judgments and theoretical scenarios and economic statements that represent "what should be" rather than facts and cause and effect. Normative economics expresses judgments about what might be the outcome of economic activity if changes in government policy are made.

PERMISSION “Normative Economics”

normative economics aims to determine the desirability of people, or lack thereof, in economic programs, situations and conditions by asking what should happen or what should be. Regulatory statements typically represent opinions about economic statements rather than objective analyzes that present facts.While positive economics describes economic programs, situations and conditions as they are, normative economics aims to prescribe solutions. Normative economic statements are used to define and recommend ways to change economic policy or influence economic decisions.

Connecting normative economics with positive economics

Normative economics can be useful for creating and creating new ideas from different perspectives, but it cannot be the sole basis for making decisions on important economic issues, nor does it take an objective angle that focuses on facts and cause and effect.

Economic statements coming from a positive economic angle can be broken down into identifiable and observable facts that can be examined and verified. Because of this feature, economists and analysts often practice their professions from a positive economic angle. Positive economics, a measurable perspective, helps politicians and other government and business authorities make decisions on important issues that impact specific policies, guided by facts. However, policy makers, business owners and other organizational bodies also typically look at what is desirable and what is not to their respective stakeholders, making normative economics an important part of the equation when making decisions on important economic issues.

Combined with positive economics, normative economics can enter into many decisions based on opinions that reflect how individuals or entire communities conceive of particular economic projects. Such views are especially important for politicians or national leaders.

Examples of normative economic reports

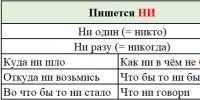

An example of normative economics might be: “We must cut taxes in half to increase disposable income levels.” In contrast, a positive or objective economic observation would be: "Big tax cuts would help many people, but government budget constraints make this option unfeasible." The example given is a normative economic statement because it reflects value judgments. This particular proposition assumes that disposable income levels should be increased.

Economic claims that are normative in nature cannot be tested or proven to actual values or legal causes and effects. Sample normative economic statements include: “Women should be given higher education credits than men,” “Workers should receive more of the profits from capitalism,” and “Working citizens should not have to pay for hospital care.” Normative economic statements typically contain keywords such as “should” and “should.”

v Distinction between positive and normative economics. "Hume's Guillotine": equivalent antonyms. Methodological and value judgments. Senior, Mill, Kearns, Pareto, Hicks, Heilbroner, Myrdal and others about normative and positive economics.

v The dialectic of the positive and the normative on the example of the general theory of “second best” and in the theory of “institutional traps”.

v The neoclassical methodology of the Austrian school is the scientific basis of normative research in economics. Normative paradigm: a model for posing problems and their solutions.

The normative and positive elements of science constitute a system of knowledge, within the framework of which judgments and descriptions of reality from the point of view of the categories of existence (positive elements) are logically supplemented and themselves complement theoretical descriptions of reality in the categories of what should be (normative elements). An abstract scientific system consists of many normative judgments and evaluations and many positive descriptions and statements.

The system of needs is the starting point of normative research in economic theory.

The formal elements of normative research in economics are determined by the general subject-object structure of any practical and cognitive activity, including such modifications as subject-subject relations. In the space of these structures, one can distinguish “ideal types” of relations of thought to reality. The first relation should be called descriptive, creating completely plausible images of reality. It is expressed in truth values (“true-false”) of object descriptions, the latter being the starting point for constructing descriptions, their verification and subsequent clarification. The second attitude manifests itself as the subject’s value perception of reality, given to him in assessments that can be very diverse: these are norms, standards, projects, guidelines, samples, conventions, rules. In this case, the object must meet the requirements of the subject in order to receive his positive assessment and approval. Consequently, non-compliance with subjective requirements entails a negative assessment. Descriptive and value relations represent idealizations of real scientific thinking, which only in special cases is completely devoid of value (normative) content and is aimed at solving descriptive (positive) problems.

The concept of normative, or value, in its most general form is associated with the field of social, economic, and philosophical studies of man and the world from the standpoint of the system of human needs. This system outlines the area of primary content of the normative approach in the social sciences. The unity of objective and subjective reality in normative economics is reduced to its subjective side, which is then reflected in the concepts of useful, useless or harmful (1). Positive economics, on the contrary, eliminates and ignores the subjective aspects of a given fact and increases the emphasis on its objective component in order to comprehend things “as they are.”

In normative analysis, the concept of value performs a special function. It shows the degree of importance for an individual of the objectively useful properties of things. In the same regard, value extends to the degree of significance of certain aspects of individual life, by preserving which a person avoids what is harmful and useless. For example, everyone knows that honesty in business affects the level of trust of partners in the business.

The problematic of the secondary level of normativity covers the sphere of what should be. If we ignore the original meaning and primary content of normativity (correlation with the system of needs) and associate the approach with the proper as a category of formal ethics and the concept of logic, then normative economics will primarily include optimization models of economic systems, deontology (the doctrine of being as proper) and logic ratings. Normative theory comprehends reality in terms of the best, good and bad, due and undue, genuine and inauthentic, fair and unfair, beautiful and ugly. The boundary between “being in itself” and “being for us” separates positive and normative sciences (there is such a division in philosophy). The laws of normative discipline indicate what should be, although it may not be, and under certain conditions it cannot even be.

In works of a philosophical nature, general social laws, which determine the parameters of economic systems, consist of three components: projections of models of social action; patterns of current social interaction; social projects of the desired society (2). But for normative economic theory, the understanding of law as it develops in the 20th century becomes essential. On the one hand, law is still viewed as a set of legal norms that underlie social justice, consolidating existing social relations; on the other hand, it is increasingly understood as a way of “constituting” social life. Legal systems make it possible to realize various ideals of society and man, including individual happiness, social equality and social discipline, personal freedom, justice, an acceptable standard of living, law-abidingness, etc. The ability of law to be a constitutive system becomes especially noticeable in the second half of the 20th century. as social state projects or socially oriented public policy are created and implemented within the framework of the modern “mixed economy”. Thus, modern law exists in the space of two dimensions: one can be called normatively descriptive, the other normatively constitutive. If the first dimension is determined by the socio-economic, political structures and processes that have developed or are developing, then the second dimension is determined by new practices, behavioral strategies and opportunities.

The implementation of relevant strategies and opportunities through such practices allows the introduction of new institutions in the sphere of economics, politics and social relations(3). For example, such institutions may be the norms and rules of social responsibility of business (4), as well as state and municipal authorities of regional territorial systems and local communities (in the modern economy there is the practice of state and municipal entrepreneurship). On the other hand, behavioral strategies of shadow entrepreneurship and criminal “protection protection” give rise to rules for opportunistic behavior of business entities, deviations in the activities of representatives of the country’s law enforcement system and evasion of officials from the normal execution of laws due to mutual responsibility and bribery.

We will consider any element of science normative if it designates and correlates in its content with an ideal (abstract) object. On the contrary, we will therefore consider any element of scientific knowledge to be positive if it is used to designate and describe a real (specific) object, which can be a thing, event, person, institution, etc. In economic theory, in addition to the basic (ontological) one, one should use the epistemological and axiological criteria for the subsequent specification of the characteristics of many normative and positive elements, but on different grounds. The typology of properties of normative and positive elements of science is presented in the table. In scientific knowledge, what is positive from an epistemological point of view is divided into theoretical and empirical knowledge, that is, into knowledge of laws and knowledge of facts. The epistemological criterion in relation to normative elements provides a division of the normative into knowledge of what is necessary (apodictic evidence) and knowledge of what should be. Finally, the application of an axiological (value) criterion to positive science helps to highlight in it knowledge of the properties of objects in the objective world as useful, neutral or harmful to humans and society. From an axiological point of view, normative science includes knowledge of the bad, the good and the best.

Both normative and positive knowledge in economic science are based on the fact that all changes in public and private life, as well as requirements for policy, the goal of which is some improvement of the situation, are rational and based on objectively real connections of things. Below we will consider several economic problems that are in the sphere of normative knowledge.

The dialectic of the positive and the normative in the general theory of the “second best” and in the theory of “institutional traps”. To illustrate the problems of normative economics, we can point to the relationship between maximizing the welfare function and equilibrium in the Paretian optimum: maximizing welfare may be ineffective, but equilibrium and meet the conditions of the Pareto optimum. To explain the stable inefficient and equilibrium situation, two theories have been developed - the neoclassical theory of “second best” (5) and the theory of institutional traps (6). Second-best theory is designed to address all maximization problems, not just welfare economics. In many cases, this theory leads to recommendations for comparing different states of affairs and assessing their impact on well-being. Pareto optimality criteria, although normative, have a very relative meaning, since situations often arise when an improvement in the position of one individual is achieved at the expense of others or together with others. The mathematical demonstration of maximization models in a situation of partial optimum is also worthy of attention.

In the theory of institutional traps ("lock-in"), from the standpoint of evolutionism, an explanation is given for the various effects of "path dependence", indicating the dependence of the evolution of the system on the trajectory of previous development. These effects - economic in essence - depend on the religious, historical and economic experience of generations. The "lock-in" theory, in addition to the evolutionary-institutional methodology, is closely related to the ideas of social and human capital in economics, and as a theoretical discipline it forms the positive content of normative economic theory. An institutional trap is an ineffective stable norm, an ineffective institution and ineffective equilibria generated by the corresponding norm (7). The theory of institutional traps takes as the reason for the temporary impossibility of improvement in the sense of achieving an effective norm, lack of coordination, cultural inertia, narrowing of the planning horizon, negative effects of learning and coupling (8). Any of these effects risks falling into an institutional trap and subsequently consolidating an ineffective institution. However, the inefficiency of an economic institution, for example, the transfer of part of the profit from taxation to the “shadow”, has different meaning, say, for the company and for the state.

By breaking the law, an economic entity hopes to maximize the utility of its decision under marginal conditions, since the equilibrium condition for a perfectly competitive firm is the equality of marginal cost, marginal revenue and price (MC = MR = P). But what is true a priori for ideal conditions of perfect competition is unsuitable for real conditions of economic activity, where subjects of monopoly or oligopoly market power act, distorting competitive interactions.

To measure the market power of a firm, there is the Lerner index (L), the value of which varies from zero (perfect competition) to one (pure monopoly). The formula according to which the index is introduced relates the ratio of the marginal profit of the company ((P - MC)x Q), where P is the price of a unit of production, Q is the volume of production, MC is the marginal cost) to total income (PQ = TR), then there is L = (P - MC)x Q/PQ. In practice, instead of marginal costs, total average costs are taken into account, so the expression (P - MC) x Q can be replaced by (P - ATC) x Q, respectively, we obtain gross profit instead of marginal profit. Dividing the firm's gross profit into “light” and “dark” masks the possible shadow transaction costs of the enterprise - the costs of ensuring economic and information security, as well as the costs that arise when exchanging property rights for economic benefits and protecting one’s exclusive rights. The volume of such transactions grows along with costs and affects the stability of firms in maintaining their market power, which perpetuates the negative effects of the tax institutional trap.

The difference in the approaches of the company and the state in the conditions of the tax institutional trap associated with maximizing tax rates and payments to the state budget can be graphically represented using the example of the Laffer curve (see figure).

The withdrawal of part of the income into the “shadow” is due, in our opinion, to high transaction costs of exchanges in transition economy. For the state, the optimal rate R1 ensures maximum revenues to the budget V1. Point a1 corresponds to the equilibrium scheme of mutual tax liability of business entities and the state. But in conditions of a trap, the actions of economic entities to optimize tax payments to the budget are equivalent to truncation of the convex part of the curve and its mirror image along the line R1, where the new point a3 corresponds to a tax trap - an ineffective stable norm, an ineffective institution with an ineffective equilibrium exchange scheme.

It is obvious that the budget needs of the state are maximized at point a1 and correspond to the conditions of the Pareto optimum: any change in the tax rate R only worsens (reduces) V. For economic entities in an institutional trap, the flow of taxes into the budget is optimized at point a3. The combination of fiscal and incentive measures of the state provides maximum revenue to the budget V2 and leads to a “groping” for the real tax rate R2.

Thus, normative analysis shows that the general rule of state action in conditions far from the Pareto optimum will be to take into account an ineffective institution and maximize its benefits in it, as any other economic entity does in conditions of an ineffective, but equilibrium exchange scheme. The state cannot invent new (effective) rules and norms, new tools and technologies of economic behavior that would exist in parallel with old and ineffective ones, and act in accordance with the new rules, thereby canceling the old rules.

An example of a normative study of the actions of economic entities in the conditions of institutional traps of a transitive economy is presented in the work of D. S. Lvov, V. G. Grebennikov and B. A. Erznkyan “Institutional analysis of the corporate form of an enterprise”, where, in particular, the mechanism of the so-called discretionary corporate management (9). Discretionary behavior by managers can be seen as a typical case of opportunism in the principal-agent relationship and at the same time as an institutional trap. Shareholders of large joint-stock companies (corporations), as holders of the title of owner, thanks to the ownership of shares of the company (that is, principals), with the help of their elected board of directors, hire qualified managers (who, together with the members of the board of directors, are agents) under certain conditions, in order to increase the profitability of their part of the share capital, ensure growth in the value of the company as a whole. However, in practice, managers begin to act solely in their own interests, ignoring the interests of the corporation and shareholders. Such management and management behavior is called discretionary.

If we extrapolate the neo-institutional “principal-agent” model to the micro- and meso-economic level, the conclusion suggests itself that there are objectively no factors preventing the formation of a similar mechanism for discretionary management of corporations by their managers in relation to the population, municipal and regional authorities.

If we take as the norm some averaged and aggregated state characteristic of the behavior of the majority, then all the traps described above are a practical imperative, since regular market transactions are hardly possible outside of these practical imperative requirements. But at the same time, everyone understands that these norms are somewhat flawed. A certain part of the interest of social science has always been drawn to norms as socially significant assessments that have an objective character of obligation, failure to comply with which would threaten sanctions. Scientific normative analysis is thus a study of the values contained in norms from the standpoint of increasing the well-being of individuals and society. The norm regulates people’s relationships and their behavior, proposing either to voluntarily comply with this requirement, or to fulfill it with the help of political, legal and socio-economic sanctions. It serves as a prescription for the mandatory behavior of a certain group of people in order to perform a certain function and maintain order. All normative concepts are included in normative judgments and allow one to evaluate the mode of functioning of an object as a “norm” or as a “pathology” from the point of view of compliance with the goals of the group. An institutional trap is therefore a set of norms that have been derived and generalized as a “second best” solution to the inability to follow an optimal and more efficient solution.

Neoclassical methodology of the Austrian school - the scientific basis of normative research in economics. The most important consequence of the analysis of the logical structure and functions of normative theory is the possibility of developing and applying a special normative discipline - economic taxonomy. Economic taxonomy is designed to distribute objects and build hierarchical systems from them according to the degree and level of value attribution, that is, according to the completeness and reliability of the presence of constitutive properties of “good” (valuable) in objects. The subject area of economic taxonomy is axiological units of measurement and categories for grouping various objects of socio-economic and economic systems into a discrete non-empty set, which constitutes the taxon.

The idea of treating economic theory as a taxonomic science is not new and is found in the methodology of the Austrian school. Flaws deductive method The Austrian school was criticized, for example, by Veblen, who, instead of the antinomy of induction and deduction, which was outdated by that time, proposed an institutional-evolutionary approach to the study of economic reality. But it is obvious that the shift in research in the marginalist paradigm from production and industrial consumption to the individual as a subject economic activity, to his needs and well-being, completely changes the relationship of categories in economic theory. In our opinion, the leaders of the Austrian school carried out a kind of “Copernican revolution”: they developed a new methodology for systematizing scientific categories, which can be defined as a normative approach in economic theory.

The Austrian school presented the first science project normative theory: the concept of economic good and, accordingly, value is based on the relationship of objects, products of labor, labor itself, etc. to the needs and well-being of a person. Actually, the qualitative side of the relationship between the useful properties of things and human well-being is expressed in the concept of value, and the quantitative interpretation of this relationship is provided by the method of marginal (marginal) analysis of economic phenomena. Thus, firstly, the basis of normative economic theory is the relationship of potential, real or imagined goods to human needs and well-being. Secondly, economics is a taxonomic science. Thirdly, the main categories of normative economic theory, which divide the scope of its problems into interrelated parts, are the categories of wealth (the well-being of the individual and society), property and activity (labor). The theorists of the Austrian school focused on the study of the relationship between a person and the objects around him, which (attitude) forms their character of good.

The fundamental inseparability of normative and positive elements of economic theory arises simultaneously with the neoclassical direction. The prerequisites for such unity lie in the axioms of microeconomics - a stable set of individual consumption preferences, equilibrium exchange patterns and rational choice. Assessing a state as “should be,” compared to the state “as is,” performs the function of normalizing states in the hierarchy of social and individual well-being from “bad” to “best.” This hierarchy is supported by political consensus and therefore depends primarily on the model of the community of the ruling elites, the methodology of socio-political management, as well as on the mode of functioning of the state - from liberal through social to network. It follows that the existence of a real state can partly combine regimes, move from one to another, or remain in the same one. The specificity of political management in modern industrial countries with representative democracy is such that the assessment of the state of the system affects a wide range of political, socio-psychological, economic traditions and attitudes.

Normative economic theory determines the best (optimal) form of production, distribution and preservation of the wealth of society and man. This aspect, regardless of wealth, is developed in the economic literature as the theory of benchmarking. The law of the optimal form of wealth involves a comparison based on cross-cultural and comparative studies of existing economic models, taking into account the development trajectory of countries, their history and the characteristics of the mentality of the population. For example, changes in gross domestic product (GDP) signal an increase or decrease in national wealth. But in the case of real GDP growth, the problem of an accurate forecast arises: how will the country’s position in the world economy, the structure of its production, the model of the economic entity, the distribution of social wealth and individual happiness change, how will social distances, statuses and roles of people develop? Aggregates describe the movement of wealth "on average." Various, mainly institutional, anthropological, sociocultural, socio-psychological indicators are required with which to study the life world of economic entities, and one of these most important indicators is the perspective in which their capabilities are displayed. Along with experience, perspective is one of the most important objective-subjective components of reality, a certain emergent quality that arises as the effect of “coevolution” of the individual and the environment. Therefore, reality is always given to a person in a “certain perspective.” The concept of perspective denotes hierarchy, order, structuring of the real possibilities of individuals to live happily, manage and develop. Other indicators from the same category may well be indicators of business and life success, social well-being, trust. Among the indicators and indicators of social statistics, these include the Gini coefficient, the structure of distribution of budgetary funds of the state and municipalities, the cost of a minimum set of food products, the distribution of the total volume cash income for 20 percent groups of the population, the cost of living, the ratio of average per capita cash income to the value of the average per capita living wage.

Normative paradigm: a model for posing problems and their solutions. The diversity and complexity of segments of the economy as a real system form methodological requirements for the development of relevant sections of scientific knowledge, a certain part of which will undoubtedly be formed within the framework of normative economic theory. The normative paradigm of science is such that when simply establishing the meaning of an ought, it is completely unimportant whether this assessment has in any sense an “objective” meaning or not, whether a distinction should be made at all between the subjectively and objectively “good.” It is enough to note that something is considered valuable as if it were in fact valuable and good. And vice versa: if, on the basis of a known general assessment, a pair of value predicates is established for the corresponding class, then this gives the possibility of normative judgments; all forms of normative judgments receive their specific meaning (13). The normative paradigm necessarily includes in its structure a motivating mental source (for example, need, interest) for proposing theories and solving problems, thanks to which various elements (ideas, values, norms, assessments, standards, styles of thinking and behavior, etc.) are integrated into one whole. Naturally, even the most “sterile” in terms of values, a positive analysis of facts cannot be devoid of interest (research, critical, educational, etc.).

The problems of the normative paradigm are determined by the needs for the reproduction of the social system from the point of view of maintaining order, harmony of general, corporate and private interests, unity of the economic, ethical and political system, complementarity of institutions, ensuring economic justice and the realization of individual life goals (positive analysis in this regard is aimed at study of necessary and/or sufficient conditions, limitations and factors for their achievement). Regulatory problems are inevitably associated with changes in scientific and philosophical ideas about the nature of man and society, which initiate a “revaluation of values” that for some time cements the foundation of the building of social sciences, as well as the economic and social policies of the state.

Subject-object opposition is a mandatory (albeit difficult to achieve) condition for the existence of social science, which establishes the “rules” of interaction between normative and positive approaches in economics. Figuratively speaking, you can choose several options for such “rules”, modeled based on the connections between the process and the result known in science. For example, the interaction can proceed like a chemical reaction, genetic mutation, epistemological negation and rupture, interaction of process and result based on complementarity.

Actually, as has been shown in the cases of theories of second best, institutional traps and generations, normative and positive analysis complement each other in the study of the norm and pathology of the functioning of a social system. The contents of norm and pathology, their real dialectical relationships constitute the area of intersection of normative and positive approaches.

Thus, the methodology of positive economic analysis is applied by normative theory in situations of determining acceptable practical deviations from norms (normative deviations) and threshold values for their maximum changes (normative torts). But, despite the clarity and obviousness of the principles of interconnection and interpenetration of normative and positive elements of economic science, the topic, in our opinion, needs further research.

So, the essence of the relationship between normative and positive problems of economics comes down to the opposition of two types of knowledge and its two functions in science. This is the opposite of realistic economics, whose interest is focused on facts known from economic experience, and pure economics, whose function is to identify the relationship of concepts and ideas. The need to develop normative elements of economic theory is due to the methodological and managerial circumstances of the evolution of the Russian transitive economy. The diversity and complexity of segments of the modern economy affect the methodological requirements for the development of such sections of scientific knowledge, the content of which, obviously, is formed in a certain dependence on normative economic theory. The normative-economic triad “wealth - activity - property” covers the system of social relations for the production and appropriation by man of the material conditions of a civilized state and free development.

Economics is a special field public life. A person not only participates in but also strives to understand their nature. Normative economics, which involves judgments about necessary actions. This distinguishes it from simple theorizing.

Economic theory is designed to study the interaction of people in the search for the most effective methods of using production resources to meet the needs of individuals. Many methods of analysis contain positive (the study of involuntary unemployment) and normative elements (methods to effectively reduce this unemployment).

Normative economics is a branch of economic science based on a number of value judgments regarding development goals and related policies, while positive economics involves the analysis of facts, on the basis of which the basic principles of behavior are subsequently formulated.

There are a number of methods of economic theory:

Inductive - a method of inference that is based on a generalization of facts;

- abstraction - a method of abstracting from everything that does not fall under the phenomenon being studied; on its basis, such economic categories as “profit”, “price”, “product” are obtained (they together form the logical basis of economic theory);

- deductive - a method of reasoning in which hypotheses are tested by real facts;

- modeling - creating a simplified picture of reality.

Positive economics is everything that happens in the present time, while normative economics determines what should happen in the future, therefore hypotheses and conclusions about all relationships in systems differ. A certain complexity of normative economics lies in the fact that in order to determine the most effective ways to achieve the norm (optimal economic state), economists need to come to one common opinion, which is often very difficult. The main problem in making a single decision is that the development of economic systems is a multivariate process.

Positive economics is not only an analysis of the consequences of certain public policies, but also a detailed description of all the activities of the public sector, as well as all the forces that carry out its programs. Economists moving beyond positive analysis leads to a transition to the sphere of normative economics, which is associated with assessing the success of various programs and developing new strategies that meet certain goals. Normative economics compares the extent to which different ones correspond to set goals and objectives.

Positive and normative economics complement each other. To make correct judgments about the necessary measures that the state should take, it is imperative to know what consequences certain actions will bring. It is also necessary to be able to accurately describe the expected events that will occur if certain taxes or subsidies are introduced for certain industries.

Discussions about the degree of efficiency of the economy are considered by positive economic theory, which is based only on facts and real dependencies. Discussion of the fairness of economics is part of normative economic theory, which makes judgments about specific economic conditions and policies. It relates not only to the problem of fair distribution of the product. Normative economics is a science that makes value judgments about the main types of choices that a person makes. economic system. Regulatory problems always cover all aspects and aspects of the economy.

Positive and normative economics

There are also positive and normative economics. Positive economics describes something that is possible to happen. Positive economics deals with facts and is free from value judgments. Normative economics evaluates economic phenomena and studies what “should be.” It predicts what will happen to certain processes and phenomena if the factors influencing these processes and phenomena are changed. Objective facts cannot prove the truth or falsity of normative judgments.

What does positive and normative economics study?

Positive and normative analyzes are often used in the study of economic problems. On the basis of this, a distinction is made between positive and normative economic theories. Positive analysis makes it possible to see connections between real economic phenomena and processes; normative analysis is based on the study of what and how it should be. A normative statement is usually derived from a positive statement, but objective facts cannot prove its truth or falsity. In normative analysis, assessments are made - fair or not, bad or good, acceptable or unacceptable.

TEST YOURSELF Give an example of a positive and normative economic statement. Name three government ministries in your country that regularly consult with economists.

Positive and normative economics. Moving on to Fig. 1-1 from the level of facts and principles (blocks 1 and 2) to the level of justification for economic policy (block 3), we make a sharp leap from positive to normative economics.

The difference between these aspects of economic theory coincides with the difference that exists between positive and normative economics. The goal of positive economics is to describe and explain the functioning of the economic system, while normative economics consists of advice, proposals, and standards for management actions in the public sphere. For example, the following statements are positive: when the price of a product increases, the demand for it decreases (law of demand) an increase in the amount of private or public investment (capital investment) leads to increased income and an increase in the number of jobs (Keynesian multiplier theory). The normative statements are as follows: it would be correct to redistribute income from the rich to the poor to achieve full employment; it would be timely to make public investments.

Depending on the approach, positive and normative microeconomics are distinguished. The first in world economic literature is considered a science along with physics, chemistry, etc. The second seems to be a set of instructions, recipes, a kind of art of doing business.

The resources that we want to use are, as a rule, limited; in any case, they are less than necessary to satisfy our needs at a given level of social development. In this regard, economic science faces a double task: objective and subjective, or, in other words, positive and normative.

Analysis is a complex technique that has various types. There are comparative analysis (comparing the particular and the general), correlation (dependence), factorial (comparing arguments and functions), positive (assuming that economics considers phenomena as they are), normative (phenomena are considered as they should be) . And economic science in the West is also divided into positive and normative. A normative approach often grows out of a positive one. Analysis is in dialectical unity with synthesis. During synthesis, an object is combined, assembled from already known and unknown parts. Analysis and synthesis cannot be considered as assembling and disassembling something. During synthesis, thought moves from the abstract to the concrete.

The entire microeconomic theory, including the theory of the firm as its important part, is based on the use of positive and normative analysis. Therefore, enterprise economics, on the one hand, like astrology, predicts the fate of certain economic phenomena, and on the other hand, it prescribes, like instructions, what action should be in order to obtain this or that economic effect.

Economic activity should be built on the basis of strategic analysis-assessment. Strategic analysis-assessment concerns the prospects of the enterprise; in contrast to the analysis of economic activities and long-term analysis, it is focused not only on future conditions in the external and internal environment of the enterprise, but also on net income from capital. Strategic analysis-assessment is a synthesis of positive and normative analysis. It consists of showing where the enterprise will be after a given period of time if such and such changes occur, and what needs to be done for the enterprise to achieve such and such results. Strategic analysis permeates all preparatory stages of economic strategy, the stage of strategy selection, development, implementation and control of its implementation and all elements of the enterprise’s operating environment.

Speaking about theories of transition and economic transformation, it is advisable, from our point of view, to distinguish between positive and normative approaches. The latter, naturally, prevails, since the demand for practical recommendations in this area is greater than for an objective description of the processes taking place.

What is the difference between positive and normative theories of economic policy Consider an economy suffering from high inflation. Under what political conditions do you think politicians will be more inclined to implement strict anti-inflationary programs?

Microeconomics is conventionally divided into positive theory, which answers the question How it is, and normative theory (welfare economics), the task of which is to compare alternative states using one or another criterion or answer the question How it should be. Normative analysis concerns both the qualitative choice of economic policy and its specific options.

The adoption of value premises as the basis of analysis makes welfare economics part of normative economics. Recall that a positive statement that answers a question as is can be verified, that is, it can be said (at least in principle) whether it is true or false. Normative statements (as they should be), on the contrary, cannot be verified; they can only be accepted or not accepted. The choice between efficiency and justice is based on different points of view on questions of distribution, and the economist, like any other person, can accept the one that is more consistent with his own views.

Many important economic terms carry the double meaning of what is and what should be. Moreover, these two sides, as a rule, are difficult to differentiate; often there is an imperceptible slippage from the positive to the normative plane. Examples of such slippage include the terms perfect competition and equilibrium, which implicitly introduce a positive assessment of the corresponding phenomena. For example, the formal meaning of the concept of equilibrium as an optimal state in a certain sense often gives way to the idea of it as a good, desirable state in general. Accordingly, equilibrium prices acquire the properties of correct, good prices.

However, there is a more comprehensive aspect to this problem (than the one just discussed) and I am not going to say that it is insignificant because of it. In particular, it remains important question, associated with public interest concerning the volume of exploitation of the world's reserves of exhaustible natural resources. As everyone knows, this aspect has recently become of interest to people due to the emergence of various apocalyptic forecasts, which combine positive judgments that the world is already approaching an irreversible collapse due to a lack of natural resources, and normative judgments that civilization is too young, to die. I am not going to discuss these forecasts and opinions now - one meeting that just ended was already devoted to them - but I would like to talk about the economic background of this problem.

The study of decisions made by users of accounting information is carried out in two directions. One studies how people should make decisions, i.e. the normative approach is carried out in a different way - how it is done in practice, i.e. positive approach. In the first case, the research usually begins with the construction of an economic model and attempts to establish what information is necessary for its operation. The second study examines how people use available financial information. The importance of a positive approach is that it allows you to get to the core of the information that is most useful. The normative approach is equally important, since many financial accounting standards are based on deductive logic and stem from normative decision models.

Subsequently, the problem of distinguishing between theoretical and practical knowledge, positive and normative approaches in economic science acquired particular interest among theorists. IN late XIX V. The English scientists J. Cairns, G. Sidgwick, as well as J.N. had a very strong influence on the development of methodological disputes. Koine, father of the famous economist J.M. Keynes. Their

When studying economics, it is important to distinguish between its two components. The first was called “positive economics”, the second - “normative economics”.

Positive Economics provides for such an analysis, during which the objective foundations are revealed economic development and a scientific justification for the functioning of a certain economic system is given. Positive economics aims to explain how society makes decisions regarding consumption, production and exchange of goods. Such studies help explain why the economy functions the way it does and provide data to predict how the economy will react to certain changes in the situation.

Normative economics makes recommendations that are based on judgments from the position of personal values.

In positive economics, the researcher carries out the analysis as an impartial scientist. Whatever his political orientation, whatever his ideas about the future or what “good” is, he, first of all, tries to find out how a given economic system really functions. At this stage there is no judgment in terms of personal orientations. In this case, positive economics is similar to natural sciences such as physics, geology or astronomy.

Thus, economists whose political beliefs are quite different would all agree that the price of a good will increase if the government increases the tax on the good. Another thing is whether this increase is desirable? This question concerns normative economics and could give rise to conflicting judgments. All economists would unanimously recognize this statement of positive economics: favorable climatic conditions will increase the production of wheat, reduce its prices and increase the level of its consumption. So, numerous provisions of positive economics do not raise doubts about their validity among a wide range of economists.

Along with this, there is a significant range of problems that remain insufficiently clarified and regarding which there is no consensus among economists. Of course, scientific research solves some of them, but inevitably new problems arise that create new relationships.

Normative economics is based on judgments in terms of subjective values rather than on the search for objective truth. An example that includes elements of positive and normative economics: “elderly people incur higher medical expenses than the rest of the population, and the government should subsidize these expenses.” The first part of this prediction, according to which older people incur high medical expenses, belongs to positive economics. This assumption states the real facts of social life, and we can show through detailed research whether this statement is correct. The validity of the second part of the provision, the recommendation regarding what the state should do, can never be proven no matter how research methods are applied. This is nothing more than a value judgment based on the feelings of the people who make this proposal. Many people may share this subjective opinion based on the fact that all members of society should have the same ability to pay for basic necessities, as well as allocate certain funds for recreation and the purchase of luxury goods. But others might reasonably disagree, believing that it would be better to use society's limited resources to improve the environment.

It is virtually impossible to find a method of scientific research that can be used to prove that one of the statements of normative economics is correct and another is incorrect. It all depends on priorities or preferences individuals or societies that must make decisions. However, this does not mean that economics cannot shed any light on normative issues. We can turn to positive economics to illustrate in detail the consequences of a given choice. For example, we could show that the lack of subsidies for medical expenses for the elderly will force those under sixty years of age to take greater care of their health in order to eliminate disease before it becomes expensive to treat. Society will be forced to spend more money on the necessary equipment so that people can prevent disease, and this, in turn, would leave fewer resources for improving the environment. Positive economics can serve to clarify the list of possibilities among which society will need to make a final normative choice.

So, positive economics is the scientific basis for making certain regulatory decisions.

When studying a course in economic theory, it is necessary to distinguish between positive and normative judgments. Theoretical generalizations resulting from positive analysis certainly have a scientific character. Normative statements can be scientifically substantiated if they are related to facts that can be interpreted by positive economics. At the same time, normative guidelines may be too ideological, associated with the interests of certain groups or classes and have nothing to do with the scientific foundations of the economic development of society. All these aspects of positive and normative economics must always be kept in mind when studying courses in political economy, micro- and macroeconomics, and the history of economic doctrines.